Silicon metal is the core raw material of the silicon energy industry chain. Silicon metal have three major downstream industries—polysilicon, silicone, and aluminum alloys. Those are vital to China’s strategic goal of achieving “carbon peak and carbon neutrality.” Polysilicon is essential for solar photovoltaic and semiconductor manufacturing. It is stable supply is crucial for transforming China’s energy structure and advancing semiconductor technology. Silicone reduces carbon emissions by replacing traditional carbon-based materials. Silicon aluminum alloys contribute significantly to the lightweight and green development of new energy vehicles. Silicon Metal Futures plays an important role at advancing China’s strategic goals.

Despite being the world’s largest producer, consumer of silicon metal, China’s domestic silicon market lacks a unified open market price. In 2022, China accounted for 79% of global silicon metal production capacity and 78% of output, with consumption reaching 3.132 million tons. However, market price fragmentation remains common, affecting the maturity of the domestic market and restricting China’s global competitiveness.

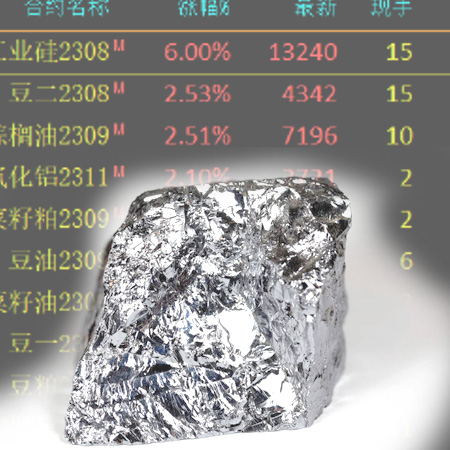

Silicon Metal Futures Market

To address this challenge, China has launched silicon metal futures trading. That is to say, this initiative aims to stabilize the supply of silicon, enhance the resilience of the industrial chain. Also, it improves global bargaining power through the futures market’s price discovery, hedging, and resource allocation functions. By establishing a more transparent and unified pricing mechanism, the futures market can help mitigate the volatility in silicon metal price. Ensuring a stable supply chain that supports downstream industries.

Silicone, as the main consumer of silicon metal, is hopefully to maintain an annual growth rate of over 10%. Driven by the “dual carbon” goal, the application of silicon metal in photovoltaic power generation, new energy vehicles, and other fields will expand. Silicon providing strong support for the development of related industries. The growing demand for electric vehicles and energy-efficient buildings further underscores the importance of silicon. By replacing traditional materials with silicone, industries can reduce their carbon footprint and contribute to environmental conservation.

With the rapid development of new energy and renewable energy, China’s demand for silicon metal is expected to reach 4.8 million tons by 2025, with a market size approaching 100 billion yuan, indicating strong growth potential. This growing demand is driven by the increasing adoption of renewable energy technologies and the expansion of the semiconductor industry. The stable supply of silicon metal is critical for manufacturing high-efficiency solar panels and advanced semiconductor devices, both of which are essential for reducing carbon emissions and advancing technological innovation.

China’s Strategic Goals

The launch of silicon metal futures provides an effective risk management tool for enterprises. As a result, companies involved in the silicon metal industry can hedge against price fluctuations, ensuring more predictable financial outcomes. This financial stability allows businesses to invest confidently in research and development, leading to technological advancements and improved efficiency. Additionally, the futures market facilitates better capital allocation, enabling firms to optimize their operations and reduce costs.

Furthermore, by integrating global information, trade, and capital flows, silicon metal futures will help China enhance its voice and influence in the allocation of global green financial resources. This increased influence is crucial for shaping international policies and standards related to sustainable development and environmental protection. As China continues to play a leading role in the global green economy, its ability to set market trends and drive innovation will be stronger.

In conclusion, the launch of silicon metal futures trading is a strategic move that supports China’s broader economic and environmental objectives. It addresses the current market fragmentation and strengthens China’s position in the global silicon metal market. By providing a stable supply, this initiative contributes to the realization of sustainable development goals and green economy.